RMB Devaluation, Chinese Foreign Reserve and Gold Price

August 19, 2015

On May 29, 2015, The Wall Street Journal reported:

“On May 22, 2015, Yi Gang, the Vice-Governor of the People’s Bank of China (the “PBoC”) said at a forum in Beijing that “It’s not necessary” to bolster growth by devaluing the yuan. Mr. Yi pointed to China’s trade surplus, which has narrowed in recent years but remains relatively large, indicating Chinese exports are still strong.”

On August 12, 2015, Yahoo news reported:

“China cut the yuan’s value against the dollar for the second consecutive day Wednesday, roiling global financial markets and driving expectations the currency could be set for further falls.

The daily reference rate that sets the value of the Chinese currency against the greenback was cut by 1.62 percent to 6.3306 yuan, from 6.2298 on Tuesday, the People’s Bank of China (PBoC) said in a statement on its website.

The move took the reductions to 3.5 percent this week — the largest in more than two decades — after a surprise cut on Tuesday, but the central bank played down expectations it would continue to depreciate the currency.

The combined drop is the biggest since China set up its modern foreign exchange system in 1994” , when it devalued the yuan by 33% at a stroke.

This sudden change of course is not typical of Chinese central planners. What happened in the three months that led up to such a dramatic about-face?

1. Slump in exports?

On August 8, 2015, Reuters reported:

“Chinese exports tumbled 8.3 percent in July, their biggest drop in four months and far worse than expected, reinforcing expectations that Beijing will be forced to roll out more stimulus to support the world’s second-largest economy.”

2. Deteriorating Current Account?

The current account is an important indicator of a country’s economic health. It is defined as the sum of the balance of trade (goods and services exports minus imports), net income from abroad, and net current transfers. A positive current account balance indicates that the nation is a net lender to the rest of the world.

3. Slowdown in Foreign Direct Investment?

4. Slow Down in GDP?

5. Sway IMF to include RMB in Reserve Currency?

On August 4, 2015, Bloomberg reported:

“The International Monetary Fund said the yuan trails its global counterparts in major benchmarks and that ’significant work’ in analyzing data is needed before deciding whether to grant the Chinese currency reserve status.

IMF staff members also opened the door to a possible delay in any approval with a proposal to postpone by nine months, until September 2016, the implementation of a change in the basket of currencies that make up the lender’s Special Drawing Rights…

China has been pushing for the yuan to join the dollar, euro, yen and pound in the SDR basket; while France has called for including the yuan, the U.S. has urged China to keep moving toward a flexible exchange rate and making financial reforms to qualify.”

Inclusion of RMB in the reserve currency basket will create demand for the RMB, as desired by the Chinese government. If the motive for the devaluation of the RMB was to appease the IMF, such a token action could hardly get the job done.

On August 19, 2015, The Wall Street Journal reported:

“the yuan doesn’t meet the IMF’s key criterion that reserve currencies must be ‘freely usable,’ meaning countries could face problems trying to buy and sell the yuan in a pinch”

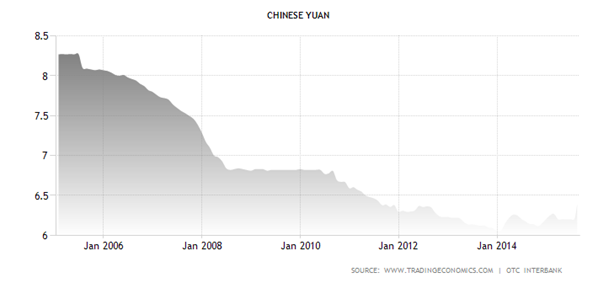

So the question is: At what level will the RMB trade if China were to leave the RMB to its own devices?

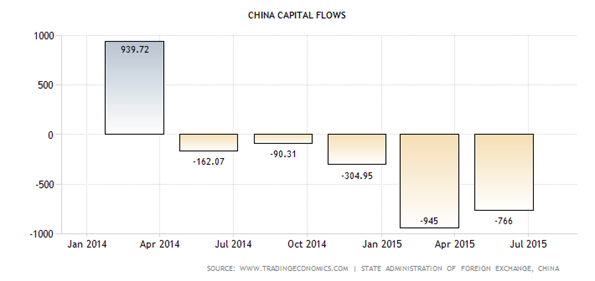

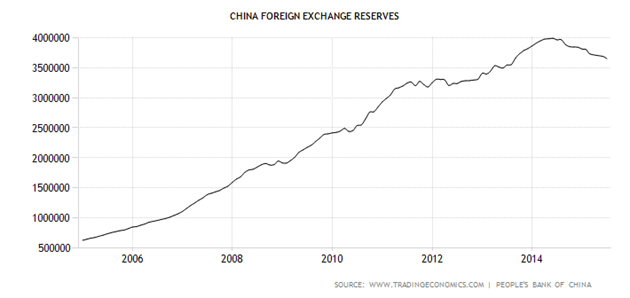

6. Hemorrhaging China Foreign Reserve and Capital Outflow?

Just the offshore RMB deposits held in Singapore, Taiwan and Hong Kong alone amount to over 1.3 trillion RMB valued at US$200 billion. How much pent-up demand exists today to repatriate money out of China from foreign speculators, funds, investors and foreign companies? Maybe the Chinese government will no longer be able to keep the flood off the gates?

China and India are two of the world’s largest gold consumers. Naturally, gold prices should have gone down when the RMB was devalued, given the reduced Chinese purchasing power for gold. Quite to the contrary however, gold prices went up during five straight trading days following the RMB devaluation.

The reason? Are RMB speculators possibly moving out of RMB into gold? This could be entirely plausible as RMB investors were likely seeking an alternative to the US dollar and the euro in the first place. Commodity currencies remained unattractive given the slowdown in the world’s economy. The gold market is small, with annual gold production amounting to approximately US$160 billion, and total above ground gold stocks amounting to approximately $8 trillion, in all shapes and forms. Even the slightest increase in physical demand for gold can have a profound impact on the price of gold.

Now that the cat is out of the bag, the run on RMB might intensify, which could force or speed up action by the PBoC to decisively devaluate RMB to approximately free market trading levels to lessen the reserve bleeding, with the added benefit of reviving export and foreign direct investment.

What is the free market RMB to US dollar exchange rate? Having visited and stayed in China on a monthly basis, I can say it’s not cheap to live in China where a bottle of beer can cost you US$10 and a modest 1,000-square-foot flat can easily set you back a cool US$2 million in Beijing. China set up its modern foreign exchange system in 1994, when it devalued the yuan by 33% at a stroke. We may just see that for the second time very soon.

Instead of focusing on the Federal Open Market Committee’s sideshow regarding the US interest rate, gold investors should monitor the Chinese foreign reserve for investment clues. I like gold’s risk-reward profile at $1,120. I own physical gold and silver and manage a company engaged in silver exploration.

John Lee, CFA

Executive Chairman, Prophecy Development Corp.

www.prophecydev.com

jlee@prophecydev.com

Author’s Biography:

John Lee, CFA

John Lee, CFA

Executive Chairman, Prophecy Development Corp.

www.prophecydev.com

John Lee is an entrepreneur with degrees in economics and engineering from Rice University. Under John’s leadership, Prophecy raised over $100 million and acquired substantial silver mining projects in Bolivia and coal mining projects in Mongolia.

David Morgan is a precious metals aficionado armed with degrees in finance and economics as well as engineering, he created the Silver-Investor.com website and originated The Morgan Report, a monthly that covers economic news, overall financial health of the global economy, currency problems, and the key reasons for investing in precious metals.

As publisher of The Morgan Report, he has appeared on CNBC, Fox Business, and BNN in Canada. He has been interviewed by The Wall Street Journal, Futures Magazine, The Gold Report and numerous other publications. If there is only one thing to teach you about this silver bull market it is this… 90% of the move comes in the last 10% of the time! Where will you be when this happens?

Offer does not apply to Premium Memberships.