Gold and Silver: Heading for a “Blue Screen of Death” Event?

David H. Smith

For personal computer users who by choice or circumstance, find themselves using a version of the Microsoft Windows operating software family, a dreaded condition known as the “Blue Screen of Death” (BSoD) is a seldom occurring, yet ever-present possibility. Wikipedia defines it as being caused by poorly written device drivers or malfunctioning hardware, such as faulty memory, power supply issues, overheating of components or hardware running beyond its specification limits.

You’re working along, thinking everything’s under control even if it’s not all that much to your liking -but at least you understand the picture…and then, Bam! Your screen goes blue! Nothing’s working. The computer tries to figure out what happened and (perhaps) do a hard reboot. Things may get back to normal…or they may not. Your system may have crashed, erasing all your work, your saved documents, your operating system’s “memory”. Now what!

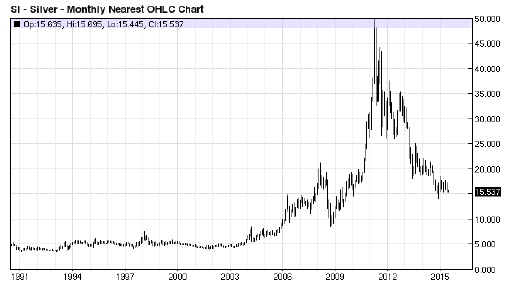

A look back at the charts shows that silver (and gold), in spite of having several attempts to move back toward their bull market highs (so far) of May, 2011, near $50, have actually remained solidly entrenched within the confines of a cyclical bear trend. Silver has lost 70% of its high-point value; gold is down almost 50%.

A Blue Screen of Death?

More on what led up to this situation later in this report. But right now, here’s the premise about what could happen in the silver space, sometime within the next 6-12 months. I’m speaking about the potential which hardly anyone expects or even believes possible of what could be called a “Silver Blue Screen of Death Event”.

If this circumstance was to come about, it would mean that the price of silver literally overnight could do a “hard reboot” launching itself upwards so quickly that if you slept in the next morning, it could be next to impossible to get aboard without taking on a massive degree of additional risk in relation to what would have been the case only a day earlier.

What might cause such an historic event? What effect would that have almost instantly on the price of silver? On the availability of the white metal? On the price of the underlying mining stocks?

Right now, mining stocks are simply “trading dollars”

Only a handful of primary silver producers are doing better than trading dollars from their sales, after All In Sustaining Costs (AISC) are considered. After subtracting the cost of doing business, getting the silver ore out of the ground, mill and turn it into Concentrate or Do?e for the smelter, little or no profit remains.

About two-thirds of silver production actually comes as a by product from large base metals’ producers, making silver profit much less of a concern for them.

The only way most primary silver producers show a profit is to include returns derived from base metal production zinc, lead, copper into their dollars’ return mix. When you see a company reporting sales of X amount of “silver equivalent ounces”, that is what has taken place. Some mines have a fair amount of gold production included as well. The silver/gold ratio now stands at around 75:1, so you can see how even a small amount of gold production can distort the value/profitability of silver mined by itself.

Of course, mining stock shares have been eviscerated. The biggest producers are down 40-70%. Exploration companies without near term production or buyout stores are off 90-95%. Hundreds more have simply blown away.

Zombie miners litter the landscape

I read a series of news releases recently from a company in which I once held a large position. They had a good “story” from an excellent location in a great jurisdiction in eastern Canada. The gold is deep, but it’s there. Unfortunately the management wasn’t “all there”. They squandered millions of dollars trying to “prove up” a number of disparate properties, rather than focus on the best one and get it into production, sell or JV it to a major producer. All the while, the Management and Directors paid themselves fat salaries, eating up their working capital.

Their incompetence and lack of focus severely tarnished the reputation of at least one highly capable analyst. Both of us, and many other investors, lost quite a bit of money as operations slid into irrelevance. Now they’re raising $100,000 at a time which barely pays for one deep hole. They pay 10% of the principle and issue millions of new shares diluting remaining shareholders, in order to “continue a drill program” and pay for “other (unspecified) operational expenses”.

I visited another company several times which was on our watch list at The Morgan Report, but that never made it to the recommended portfolio as a speculation. It just did a 10:1 share rollback after several seasons of drill results that were interesting, but as they say in the trade, “no cigar”. They work a highly prospective, remote area in Canada, and are fortunate in that so far they are being bankrolled by a Major. But if they don’t find that cigar within the next drill season or two, they risk becoming footnote, in what has become by most accounts, the worst Canadian resource sector downturn of the past two generations.

Silver: Wearing You out or Scaring You Out!

David Morgan at themorganreport.com famously remarks that a silver downdraft “will either wear you out or scare you out.” Boy has he ever been right on that one!

Some mining companies have literally “gone to pot” marketing legal marijuana, as their previously worked mining operations go “up in smoke”. Several high profile precious metals’ analysts are now writing about uranium, instead of gold and silver!

Silver Supply…

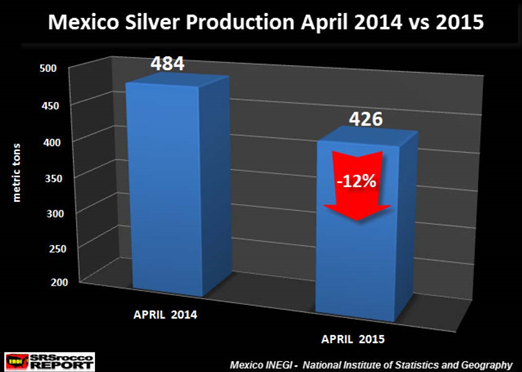

Just this month, Steve St. Angelo at srsroccoreport.com reports that production from Mexico, the world’s largest silver producer, dropped 12% in April compared to the same month last year. Could this be a one-off event? Possibly, but looking at stats for the principle Mexican states involved, all but one shows a decline. This is not just one mine with a flooded shaft, or slowing production while adding a new ball mill. If silver production in Mexico continues to decline, the proverbial handwriting for longer term supply may be on the wall.

On the demand side…

- So far this year, India has purchased 40% of the world’s newly-mined silver.

- China, which used to export 100 million ounces annually, now imports it.

- Canadian Silver Maple Leaf sales continue to flirt with another annual record.

- New uses are found for silver in industry and medicine on a daily basis.

- Total U.S. 1st quarter silver imports are up 531 metric tons from last year

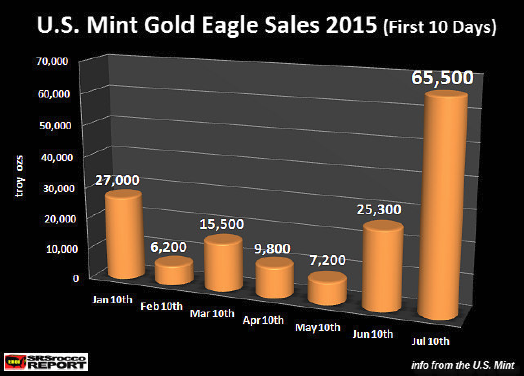

- On Tuesday, July 7th, 1 million American Silver Eagles were sold, causing the U.S. Mint to suspend sales for 2 weeks, until new blanks could be procured. (In all of 2014, investors bought about 43 million Silver Eagles. .)

Declining grades and amount of silver output – most taking place right now below the cost of production – leased metals’ and futures contracts, in addition to financial derivatives amounting to hundreds of trillions of dollars around the globe. These factors taken in total, are stimulating the tectonic plates of silver supply and demand like never before. Something has to give, and it will sooner rather than later.

Steve St. Angelo, in a major new silver report here, has noted that investors tend to ramp up purchases of silver when the price is either moving strongly up or down. When it trades in a broad sideways movement, chartists refer to as “congestion”; physical purchases, especially of Canadian Silver Maple Leafs and American Silver Eagles, tend to decrease.

As if to prove his premise in short order, on Tuesday July 7, 2015, in the wake of the Greek “No” vote the preceding weekend about paying back massive loans from the ECU, silver dropped over a dollar an ounce in early morning trading, eventually closing down .55 cents on the day. Sales of American Silver Eagles reached such a crescendo (over one million that day alone) that the U.S. Mint announced it was temporarily suspending sales in order to replenish its supply of blanks.

Record short sales of silver futures contracts on the COMEX (or as cynics call it, the “CRIMEX”), are a short term bearish, longer term bullish factor. Bearish short term, because heavy shorting (where investors make money if prices drop) may portend an attempt to push silver into new lows for the move. Bullish, because if lower prices don’t materialize, or when the shorts try to take a profit, the price will be bid up substantially and quickly. Whenever a short moves to offset his/her contract(s), they must do the opposite of the initial trade, in this case buying back the contracts they originally sold. This demand, in addition to new investors who believe the price will rise, and who therefore buy their own new contracts, initiates a powerful upwards impulse..

Whether or not this buildup by the shorts portends “another leg down” in the silver price remains to be seen. At this writing the area around the 4 year lows printed last November at $14.15 are still holding. Either way, the ongoing crush of events underscores just how unstable and unpredictable the global financial house of cards has become. Given that gold and silver have been, for thousands of years, the “money” of last resort, it’s probable that as we approach the next financial unraveling, people will once again seek to hold them as preferred “insurance” if they can be found.

How a Silver Blue Screen of Death Event Might Look:

It’s a Sunday evening…

- In overnight markets, the price of Silver rises $2 – $4 an ounce.

- In pre-open trading the next day, silver stock ETFs open 50% higher.

- American Silver Eagles/Canadian Maple Leafs sell out in a few hours.

- Premiums on “junk silver” triple from the previous day’s level.

- Local coin shops sell out of physical silver by noon the next day.

- Silver moves up sharply each day and ends the week $15 higher.

- Over the next two weeks, silver retraces just 25% of its meteoric price rise, forming what technicians call a “bull flag”. On the third Monday, the “moon shot” continues, easily breaking through multi-year resistance at $38, then $44, and finally the all time (nominal) highs above $50, closing a few weeks later at $75 an ounce.

- For several months the price forms a broad trading range below a spike high at $80, but is unable to drop below $55 an ounce. Almost no retail metal is available, and when it is, the premium is $15 over spot. Primary silver mine producer stocks trade well above their 2011 highs, in some cases 50 times higher than their bear market low.

- Unlike 1980, silver trading this time is a global phenomenon. Internet news is instantaneous, with Chinese markets setting the price. The COMEX has defaulted on its futures’ contracts and settles by paying out paper promises.

Four months later, silver prints a new all time nominal high and surges into the $125-$175 per ounce range, in the biggest metals’ bull market in modern history. Gold penetrates $6,000 per ounce on the upside.

Note: Even at $125 an ounce, silver would still be cheaper in inflation adjusted dollars than it was in 1980! Is such a scenario possible? Stay tuned…

Gold’s real value is after the crisis has passed.

Sometimes you will hear a person remark that “You can’t eat gold in a crisis.” Well, that’s true. But where gold (and silver) really shine is during the period after a currency has been devalued sharply (think Venezuela, Mexico, Argentina) or has collapsed outright (think Zimbabwe and again, Argentina). When the old currency is removed from circulation, your precious metals which will have retained their pre-revision value can be exchanged for the new currency.

Ask a Zimbabwean citizen if they would rather have traded one trillion old Zimbabwe dollars for one new one, called a “banknote”…or an ounce of gold for $1,400 new U.S. Dollars one of several international currencies now being used for domestic transactions? Think about yourself in a similar situation some day.

Perhaps we cannot hold accountable, those who serve themselves first, and us not at all. But we can take it upon ourselves to follow the spirit chronicled in Dr. Janice Dorn’s and Pat Gorman’s inspiring book, Personal Responsibility: The Power of You. Do whatever you can to make yourself independent of the government. Keep some cash outside the bank, but within your reach. And hold physical gold and silver, either in direct possession, or in an allocated segregated account.

Hugo Salinas Price, is one of Mexico’s wealthiest citizens. Two years ago, in an open letter to the Greek government, he suggested they mint and circulate a one-tenth ounce silver coin that would trade alongside the euro, or a reinstated Greek drachma fiat currency. It’s value would rise with the spot price, and never be reduced. The proposal fell on deaf ears, but the game is not yet over. A few months ago, he had this to say about the financial mess now enveloping much of Europe, even as the same kind of storm clouds build here:

This is apocalyptic. We are in a terrible mess, and there is no way out without suffering. Apocalypse means prices are going to go haywire. Business is going to stagnate. Unemployment is going to prevail. There is going to be enormous disorder. That’s what I see will happen. We are not going to get out of this mess easily. It is going to be painful. One way to avoid pain is to have something you will be able to trade for what you need – and that is gold and silver.

Whom do you believe to be more prescient and trustworthy? Whose advice makes more sense? Hugo Salinas Price? Or the central banker/politician who keeps telling you that there’s absolutely nothing to worry about…until the message changes over the airways on a Sunday afternoon…?

It’s About Confidence

As long as people retain faith in the banking system, and what politicians tell them, the charade will continue. Greece’s near-default, the Chinese stock market melt down (where investors have been told they cannot sell their stocks for six months), cyber attacks which have laid bare the personal information of tens of millions of Federal Government employees as government watchdog agencies again failed “to connect the dots”. How much more will it take?

On Wednesday, July 8, there was a “glitch” or a so called “technical hiccup” on the New York Stock Exchange, the world’s largest, forcing a three hour trading halt. The Washington Post described it thus: ‘So what exactly went wrong?’ We’re not 100 percent sure. NYSE officials called the problem an “internal technical issue” early in the day. There are some reports that the exchange was planning to update some of its software Wednesday morning. It may be that those updates went awry…

It may have been a big deal. Or it may not have been. What you can be sure of however, is that “the government” in its infinite wisdom, is not going to tell you the truth unless it’s in their best interest. Don’t forget, that confidence contains the word “con”. Time and time again the Federal Reserve, major banks, financial houses and politicians have said one thing at the time, and then something else in the event. We might find out years later, only by queries through the Freedom of Information Act, that they were lying.

The Authorities understand that once confidence evaporates, the game is over. So they will do and say anything in order to keep the masses of people believing all the while lining their own pockets. Study history, and you’ll see that this is nothing new. People for thousands of years have understood this, and the more alert among them have taken steps to prepare accordingly.

Analysts have known that Puerto Rico was on a path to bankruptcy, though at the present time they technically cannot file for it. But the obvious can no longer be hidden. This July, in an event rare in the annals of political history, Garcia Padilla, the Governor of Puerto Rico, commenting on that commonwealth’s inability to pay its $72 billion debt, publicly stated the unvarnished truth:

The debt is not payable. There is no other option, I would love to have an easier option. This is not politics. This is math. Further to the point, he concludes, My administration is doing everything not to default. But we have to make the economy grow. If not, we will be in a death spiral.

For a long time, nothing systemic happens because people have “confidence”, because “the government” has “everything under control”. And then…everything seems to happen all at once, and it doesn’t. When systemic issues are merely papered over rather than dealt with in a realistic way, this is what you get.

Bill Holter, collaborating with Jim Sinclair, recently wrote the following:

Once the belief that “debt is an asset …or even money” is broken, just as a spooked herd of cattle runs wild, so will investors. They will seek the safety of “no one’s liability” because no one will be trusted. This includes the central banks and sovereign treasuries themselves. Gold, (no one’s liability) will not pay you interest and will not make promises that cannot be kept, it will simply “remain”. Gold will remain as the world’s purest asset and purest money. In a world where most all “assets” are finally understood to really be someone else’s liability, there is no telling what value might be placed on the purest form of asset/money? Gold will be seen as the “anti liability of last resort”. I guess better said, gold is the ultimate central bank for the asset side of the balance sheet!

…………………………………………………………………………………………………………….

David H. Smith is Senior Analyst for The Morgan Report and a regular contributor to Money Metals Exchange. He has investigated precious metals mines and exploration sites in Argentina, Chile, Mexico, Bolivia, China, Canada, and the U.S. He shares his perspectives with readers, the media and audiences at North American investment conferences. This essay first appeared on the BuySilverNow.com.

David Morgan is a precious metals aficionado armed with degrees in finance and economics as well as engineering, he created the Silver-Investor.com website and originated The Morgan Report, a monthly that covers economic news, overall financial health of the global economy, currency problems, and the key reasons for investing in precious metals.

As publisher of The Morgan Report, he has appeared on CNBC, Fox Business, and BNN in Canada. He has been interviewed by The Wall Street Journal, Futures Magazine, The Gold Report and numerous other publications. If there is only one thing to teach you about this silver bull market it is this… 90% of the move comes in the last 10% of the time! Where will you be when this happens?

Offer does not apply to Premium Memberships.