General Access, Investment Scoring and Timing Newsletter

Silver Price Extremes!

November 6, 2014

To identify “buying opportunities” in “extreme” situations, we identify historical extreme situations and use them for a benchmark. Provided that a correction occurs in an active bull market, the insights from this kind of analysis can be very helpful.

Most should agree that the credit crisis was a major economic event that pushed nearly all assets down to an extreme low. We have used this kind of extraordinary market action as a comparison for the current commodities correction.

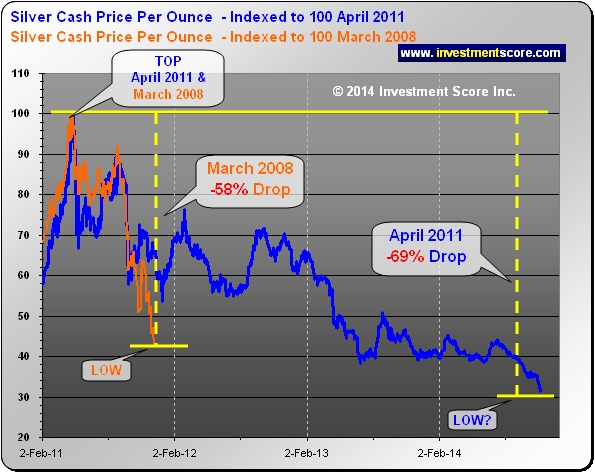

In the above chart we simply measured the percentage drop of the current correction and compared it to the extreme drop back in 2008. Based on this chart it is safe to say that the current correction could be considered extreme.

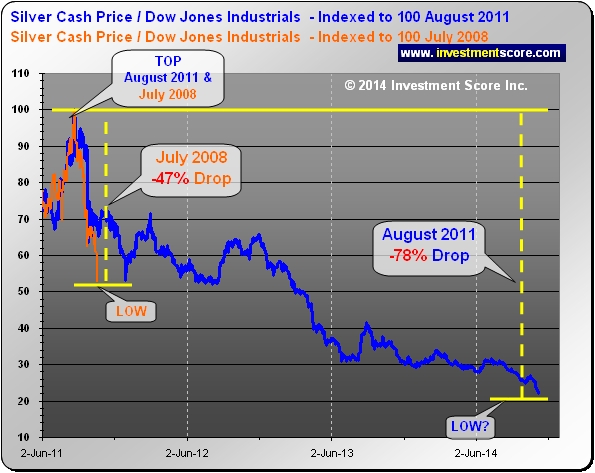

The above chart illustrates the two extreme corrections relative to the Down Jones Industrial Average. The above lines are a ratio of the silver price divided by the Dow Jones, and we can see that the drop since August 2011 has been much larger than 2008. Using the drop following July 2008 as a benchmark, it appears that selling stocks and buying silver at this time may be a great opportunity.

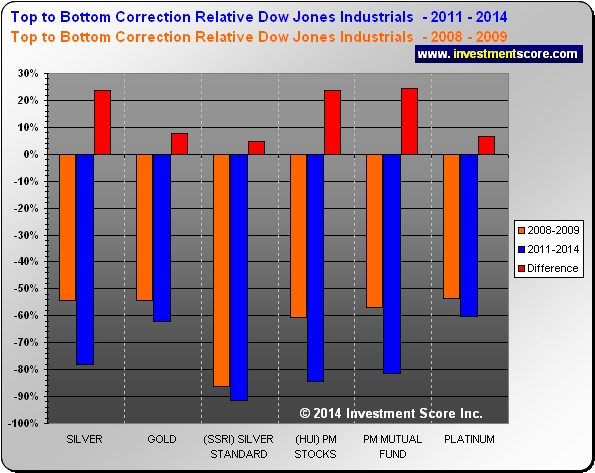

Here are some other 2008 versus 2011, Dow Jones Industrials comparisons:

In the above chart we can see many examples of the extreme correction since 2011. The current drop from top to bottom (2011-2014) even exceeds the Credit Crunch of 2008 & 2009. When silver hit a low of $8.88 in 2008, it then climbed over the next couple of years to an impressive price of $48.70. Using the past as a guide, it may make sense to sell some Dow Jones Industrial Average (Stocks) and buy some precious metals related investments.

David Morgan is a precious metals aficionado armed with degrees in finance and economics as well as engineering, he created the Silver-Investor.com website and originated The Morgan Report, a monthly that covers economic news, overall financial health of the global economy, currency problems, and the key reasons for investing in precious metals.

As publisher of The Morgan Report, he has appeared on CNBC, Fox Business, and BNN in Canada. He has been interviewed by The Wall Street Journal, Futures Magazine, The Gold Report and numerous other publications. If there is only one thing to teach you about this silver bull market it is this… 90% of the move comes in the last 10% of the time! Where will you be when this happens?

Offer does not apply to Premium Memberships.