The shot just heard ’round he world (for those with ears to listen) was a surprise 2% devaluation by the Chinese of their currency the yuan. I have spoken to many whom I respect to hear their opinions and theories. This is a very important move by China and one which will affect the entire financial world. Getting this “completely right” may be quite tough, but getting it mostly right is imperative.

Let’s begin by making a comparison. I have in the past compared today’s China and the U.S. to the last great global bubble and deflation centered around the U.S. and Great Britain. China is today’s up and coming financial and productive economy while the U.S. has lived off the fat as the reserve currency and entered decline as Britain did 80+ years ago. In the early 1930’s, “competitive devaluations” were used to beggar thy neighbor and steal market share of trade. This, along with tariffs (Smoot-Hawley for example) were put into place. International trade collapsed just as it is beginning to again today with clear evidence. The global economy lives on trade and will also die by it (or lack of!).

So why the devaluation? First, it needs to be said China does not think like the West does. They are not full blown capitalists and any edict from Beijing, right, wrong or indifferent will be followed almost blindly. To a large extent they are still a “command” economy but have moved toward allowing capital to find its highest and best use. This also comes with the baggage of speculation which often times produces bubbles. No doubt malinvestment has occurred in stocks, real estate, commodities, production and yes, DEBT. The picture is not very different from that of the U.S. back in the second half of 1929 (with the exception of a few short seller “executions”).

The Chinese move certainly argues against any rate hike in the U.S.. In fact, the yuan has risen over the last 5+ years, this has been desired by the U.S.. I can only assume a devaluation is not desired. Any further devaluations can be viewed as against U.S. desires and a direct shot back at the “IMF and friends”. Though the devaluation is much smaller than the Swiss earlier in the year, losses into a very levered and illiquid global market will need to be absorbed. How this is done will be interesting as China just issued margins calls on many markets. China also has made capital flight more difficult recently, some of the world’s hot real estate markets will (already are”) feel the pinch. Again, remember the backdrop is a very illiquid world right now!

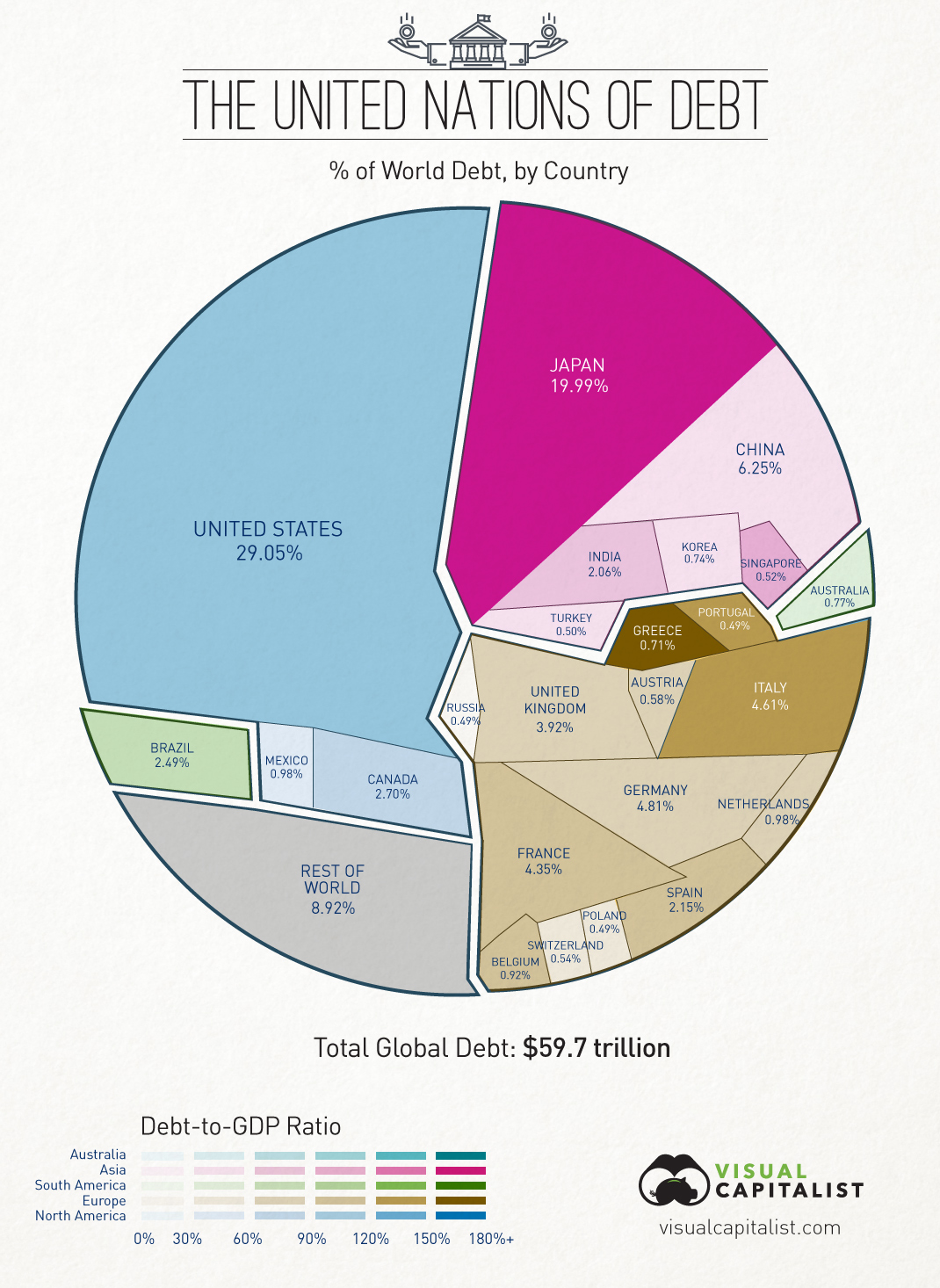

China has lowered rates and eased monetary policy several times recently. They have outlawed short selling and done whatever they could to stem the meltdown in their markets to no avail. Devaluing is the next logical choice but already we see the bandwagon of reaction where Russia, India and Thailand are all considering devaluations of their own, the currency war is going into overdrive. This is not so much about currencies as it is about market share of trade. The problem is this, the global “pie” of GDP and thus trade is beginning to shrink. Liquidity (remember the IMF recently warned of this) is tightening everywhere which means cash flows are shrinking. The ability to meet debt service requirements are becoming more difficult in a world saturated in debt.

In essence, China’s debt bubble is popping and along with it comes deflation. This devaluation, though small (for now) aims to “export” some of the deflation to their trading partners. The current move should not be seen as a one off move, it will not be and further devaluations can be expected. China is simply doing and will do what “is good for China”.

I believe China asked for inclusion in the SDR basket while believing it would not happen. They have already set up trade banks, credit facilities, currency swaps and even clearing systems not to mention wooing new trade partners. Their rebuke however should not be taken lightly. Even if China did not expect to be included, their public rebuke now gives them a public reason to do what is good for China. China can no longer be blamed for anything they do in their own self interest. This would include moving away from trade in dollars and also changing partners. It would also include the massive sale of U.S. Treasuries and dollars themselves. I would not be shocked to hear of oil, China, Saudi Arabia and “renminbi settlement” all in the same sentence shortly!

If I am correct and this is not a one off devaluation, much of the world’s population will shortly sniff out some of the ramifications. Remember, China invented paper currency and are professionals at blowing them up, their people are students of history and know this. A full out stampede into gold (and silver) before their currency gets devalued again and again may very well start. The Western banks are short paper gold, owing gold contractually, China knows this and knows it is THE Achilles Heel to the dollar. If the Asian population were to go on the rampage buying physical metal and created a vacuum of availability, the West will be shown to be naked. Could Washington accuse China of “busting” the exchanges? Is the very stubbornly high open interest in silver of Chinese origin? I believe we will find out that yes, it is and has been for well over a year. (My “Kill Switch” theory now might make batter sense but a topic for another day).

Please understand this, China fully understands consumers in the West are tapped out. They can see through the bogus numbers Washington produces and the wonks on Wall St. continually tout. They understand the Western system is built entirely on debt as in I OWE YOU! And they understand the system was set up originally as an “IOU nothing” system! They understand “it’s over”.

I do believe China wants to assume “a” if not THE reserve currency status in the future. They know they possess more gold than the U.S.. Would it not make sense to devalue your currency and even make it undervalued for the start of a new system for competitive reasons? Yes I know, they do not have enough gold to back the yuan currently …at current price. Will they pull a page out of FDR’s playbook and revalue gold higher since they are the largest hoarder in the world? Could they confiscate from their loyal citizens to leapfrog their holdings even further? Remember, the tried and true way(s) out of deflation are to print, devalue (versus neighbors AND gold) and of course go to war. Whether you want to believe it or not, we are now at war both financially and technologically. Unfortunately, financial and trade wars often times turn into hot wars. China just fired a shot heard ’round the world for those listening and it was not a celebratory shot by any means!

To finish, could it be China knows this will end in a complete collapse of the financial markets AND real economies of the world, in particular of the West? They already have the largest productive capacity in the world. Are they going to devalue their currency so it is “competitive” when the reset occurs? Have they stripped the West of their gold reserves leaving China with the greatest “monetary” hoard on the planet? Could there be a better position to be in than having the most “money” and greatest productive capacity …with a middle/lower class of your society numbering in the hundreds of millions needing “stuff” to truly enter the 21st century?

I will leave you with this graphic from Visual Capitalist: (click image to enlarge)

In a world levered to the gills and the ability to grow out from under, which is better to have? Assets or liabilities? Lot’s of questions with answers soon to be revealed I believe!

Standing watch,

Bill Holter

Holter-Sinclair collaboration

David Morgan is a precious metals aficionado armed with degrees in finance and economics as well as engineering, he created the Silver-Investor.com website and originated The Morgan Report, a monthly that covers economic news, overall financial health of the global economy, currency problems, and the key reasons for investing in precious metals.

As publisher of The Morgan Report, he has appeared on CNBC, Fox Business, and BNN in Canada. He has been interviewed by The Wall Street Journal, Futures Magazine, The Gold Report and numerous other publications. If there is only one thing to teach you about this silver bull market it is this… 90% of the move comes in the last 10% of the time! Where will you be when this happens?

Offer does not apply to Premium Memberships.