Security of Supply

Richard (Rick) Mills

Ahead of the Herd

As a general rule, the most successful man in life is the man who has the best information

While working for Shell Oil during the 1940’s Dr. M. King Hubbert noticed the production of crude oil from individual oil fields plotted a normal bell shaped curve. Roughly half of the oil from a field has been exhausted when the bell curve peaks.

Carrying that insight further he surmised that oil production from a group of oil fields would follow a similar bell shaped pattern.

In 1956 Dr. Hubbert predicted the cumulative group of oil fields within the US would reach peak production in the 1970’s, and thereafter decline – no matter how much money would be thrown at exploration and development of reserves US oil production would not rise higher after this date – his prediction was uncannily accurate.

There are a few things we can learn from studying oil production on the upside slope of Hubbert’s bell curve.

As oil production nears its peak:

- Oil becomes harder to find

- Discoveries are smaller and in less accessible regions or geologic formations

- Costs are higher to produce the crude from these discoveries

- Producing oil from existing fields becomes more expensive – recovering the last barrel of oil is more expensive than recovering the first barrel

Mine production of many metals is showing a number of similarities:

- Slowing production and dwindling reserves at many of the world’s largest mines

- The pace of new elephant-sized discoveries has decreased in the mining industry

- All the oz’s or pounds are never recovered from a mine – they simply becomes too expensive to recover

There are a few differences between mining and oil:

- Mining is more cyclical than oil which make mining companies even more reluctant than oil companies to spend on exploration and development

- There is no substitute for many metals except other metals – plastic piping is one exception. For oil substitution you have shale gas, coal liquefaction, nuclear power, oil sands, ethanol or bio-diesel, solar, geothermal and wind

- Metal markets are much smaller than the crude oil market so speculation is a larger factor

- There hasn’t been a new technology shift in mining for decades – heap leach and open pit mining come to mind but they are both decades old innovation. Oil producers have exploited new drilling and production technology to produce oil and gas from new types of reserves – oil sands and gas shales.

Increasingly we will see falling average grades being mined, mines becoming deeper, more remote and come with increased political risk. Extraction of metals from the mined ore will become increasingly more complex and expensive, even more so when one considers the effects of Peak Oil – the cost of technology innovation to power mining will be very high.

This is our reality – we’re living on a relatively small planet with a finite amount of reserves and a growing human population.

Broad spectrum peak commodities is a cause for concern over the longer term.

In the shorter to medium term there are several concerns in regards to global resource extraction we need to consider.

Project Pipeline

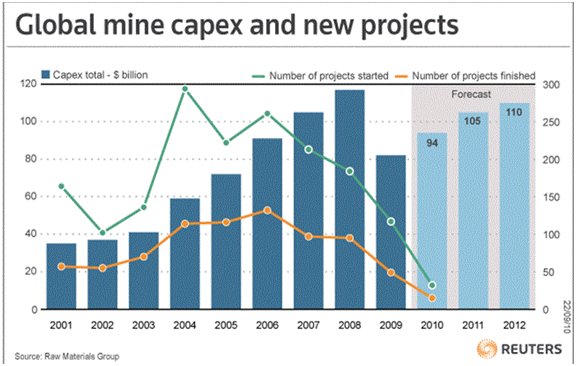

During the economic downturn miners saved their cash and paid off debt. Capital Expenditures were virtually non-existent and many projects were delayed or cancelled outright.

Below are five examples of production shortfalls looming or already existing:

Copper

“Operational constraints and cutbacks initiated in 2009 are projected to constrain mine production to 16.2 million tonnes in 2010. Looking to 2011, increased economic activity is expected to boost end-user demand for the metal much faster than production, pushing the global market deeper into deficit of about 400,000 tonnes. International Copper Study Group (ICSG)

Zinc/Lead

“Short of silver mines with strong zinc/lead by-product credits there is nothing between here and the horizon in terms of new production. This then implies that a shortage bubble is coming along and prices will spike again as they did in 2006/2007. Primary base metal sources of Zn/Pb will be heading down as mines expire and no new production appears. This is where the real crisis is brewing.” Christopher Ecclestone, Hallgarten & Company

Rare Earth Elements

In the last 10 years the global market for rare earth elements has grown to 125,000 tons per year and by 2014 demand is predicted to reach 200,000 tons per year. China, the supplier of 97 percent of this demand is lowering export quotas and might very well stop all REE exports by 2014.

Uranium

Today, there are some 441 nuclear power reactors operating in 30 countries. These 441 reactors, with combined capacity of over 376 Gigawatts (One GWe equals one billion watts or one thousand megawatts), require 69,000 tonnes of uranium oxide (U3O8).

According to the World Nuclear Association, about 58 power reactors are currently being constructed in 14 countries. In all there are over 148 power reactors planned and 331 more proposed. Each GWe of increased capacity will require about 195 tU per year of extra mine production – three times this for the first fuel load. Let’s also consider the fact that no one builds a $4 to $6-billion dollar reactor just to watch it go idle. They will order one or perhaps several year’s worth of fuel supply to guarantee it doesn’t.

In 2008, mines supplied 51,600 tonnes of uranium oxide concentrate containing 43,853 tU, which means mining supplied roughly 75% of nuclear utility power requirements. The remaining supply deficit used to be made up from stockpiled uranium held by nuclear power utilities, but their stockpiles are pretty much depleted. Mine production is now primarily supplemented by ex-military material – the Megatons to Megawatts program which ends in 2013 – the Russians have stated that the agreement will not be renewed.

Job Crisis in the Resource Extraction Sector

A combination of mass retirements and increasing natural resources demand from emerging economies has created a crisis in the resource extraction sector – one which is definitely not on investor’s radar screens.

The Mining Industry Human Resources Council (MIHRC) estimates that over 60,000 people employed in the mining sector are expected to retire by 2020 but that the industry will need an additional 100,000 people just to maintain current levels of production.

The Petroleum Human Resources Council of Canada warned a severe oil patch labor shortage is looming and that the “patch” will need to hire 24,000 new employees by 2014.

In both industries the biggest demands will be for workers to replace staff who reach retirement age.

The existing shortage of skilled personnel and the imminent retirement of so many baby boomers (many are mid level managers) means the mining sector is in direct competition with the energy sector for people to train and prospects are bleak for either industry to obtain the necessary bodies and minds.

Country Risk

One of the most serious and unpredictable risks facing mining operations and investor interests is “country risk” – where the political and economic stability of the host country is questionable and abrupt changes in the business environment could adversely affect profits or the value of the company’s assets.

Resource extraction companies, because the number of discoveries was falling and existing deposits were being quickly depleted, have had to diversify away from the traditional geo-politically safe producing countries. The move out of these “safe haven” countries has exposed investors to a lot of additional risk.

Many countries might come to mind as places where shareholders could, without warning, receive news that their operations have been taken over by the government and/or its friends, or that permits are suddenly suffering delays or have been cancelled outright.

ETFs

JPMorgan Chase & Co. has bought 50 percent of copper stockpiles in London warehouses. The purchase, reported in the Wall Street Journal, takes place as new exchange traded funds focused on copper come to market.

The ETFs are expected to put further pressure on already tight copper supplies.

“It’s another new element of demand for copper in an already tight market.” said Patricia Mohr, commodity market specialist at Scotiabank

Security of Supply

Access to raw materials at competitive prices has become essential to the functioning of all industrialized economies. As we move forward developing and developed countries will, with their:

- Massive population booms

- Infrastructure build out and urbanization plans

- Modernization programs for existing, tired and worn out infrastructure

Continue to place extraordinary demands on our ability to access and distribute the planets natural resources.

Threats to access and distribution of these commodities could include:

- Political instability of supplier countries

- The manipulation of supplies

- The competition over supplies

- Attacks on supply infrastructure

- Accidents and natural disasters

- Climate change

Accessing a sustainable, and secure, supply of raw materials is going to become the number one priority for all countries. Increasingly we are going to see countries ensuring their own industries have first rights of access to internally produced commodities and they will look for such privileged access from other countries.

Numerous countries are taking steps to safeguard their own supply by:

- Stopping or slowing the export of natural resources

- Shutting down traditional supply markets

- Buying companies for their deposits

- Project finance tied to off take agreements*

*Traditional sources of project finance have mostly dried up or are on terms that are unacceptable. Project finance is largely provided by developing nations and is usually being tied to off take agreements.

“As the potential for commodity scarcity escalates, M&A activity in the global mining sector will likely intensify, mimicking a ‘global arms race.” M&A in the Global Mining Sector – No Stone Unturned, PricewaterhouseCoopers

Conclusion

Every country needs to secure supplies of needed commodities at competitive prices yet supply is constrained and demand is growing. Barring a total global economic collapse or a dramatic reduction in the worlds human population it doesn’t seem to this author demand is going to collapse anytime soon.

The International Monetary Fund (IMF) recently published its report World Economic Outlook for October 2010 and in it they talked about commodity demand from emerging countries. “Because their growth is more commodity-intensive than that of advanced economies, the rapid increase in demand for commodities over the past decade is set to continue…the current era of higher scarcity, rising metal price trends and a balance of price risks tilted toward the upside may continue for some time.”

This author believes that there is exceptional, and as of yet, undiscovered value in junior companies with quality assets in safe stable countries.

Junior resource companies offer the greatest leverage to increased demand and rising prices for commodities.

The bottom line for investors in the resource sector is that juniors already own, and find, what the world’s mining companies and refineries need.

Are there a few junior resource companies, with exceptional management teams, on your radar screen?

If not maybe there should be.

Richard (Rick) Mills

rick@aheadoftheherd.com

www.aheadoftheherd.com

If you’re interested in learning more about the junior resource market please come and visit us at www.aheadoftheherd.com.

Membership is free, no credit card or personal information is asked for.

***

Richard is host of www.aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 200 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell.com, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor and Financial Sense.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard Mills does not own shares of any company mentioned in this report

No company mentioned in this report is an advertiser on Richard’s website www.aheadoftheherd.com.