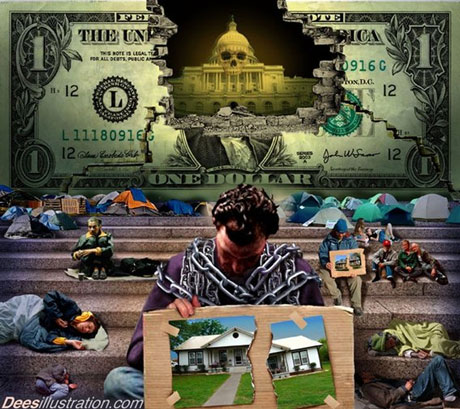

Argentina’s Financial Meltdown

Learn How To Protect Your Wealth

The Argentine Crisis: Could It Hit Here? In December 2001, the Argentinian government defaulted on $155 billion in public debt. Since then, this once-wealthy country has gone through five presidents and watched its currency fall by more than 70 percent. How do people survive in a broken economy? The solutions range from the ingenious — barter clubs where members can exchange goods and services without money — to the brutal, including outbreaks of rioting.

In December 2001, the Argentinian government defaulted on $155 billion in public debt. Since then, this once-wealthy country has gone through five presidents and watched its currency fall by more than 70 percent. How do people survive in a broken economy? The solutions range from the ingenious — barter clubs where members can exchange goods and services without money — to the brutal, including outbreaks of rioting.

Since un-hitching its peso from the U.S. dollar, Argentina has suffered a spectacular economic collapse. For market-wary Americans — shaken by the end of the bubble and economic turbulence — the questions arise:

Could Argentina’s dire economic situation ignite a new contagion that would sweep through Latin America, destabilizing the region, and further threaten America’s ill economy? And, beyond that, could something like that ever happen at home, undermining America’s middle-class stability?

With the most basic government services now only a memory and the army camped around the capital, how can the people of Argentina begin to put their society back together?

What does a financial meltdown look like? And where do American interests or responsibilities lie?

The real question we should be asking…. “When will this happen here in America?”

Watch the video below. Then keep reading to see how you can protect yourself from an economic collapse much like Argentina experienced.

Ultimately, what brought this country to the brink of an implosion was runaway spending — amplified by corruption and the breakdown in the rule of law.

Can this happen in America? If you don’t think so…. ask yourself why? What make us an different than Argentina, Cypruss or what’s currently going on in Greece?

Learn How To Protect Your Wealth

Did you know that all FIAT (PAPER) MONEY has failed?

It has a 100% failure rate!

The history of fiat money, to put it kindly, has been one huge major failure. In fact, EVERY fiat currency since the Romans first began the practice in the first century has ended in devaluation and eventual collapse, of not only the currency, but of the economy that housed the fiat currency as well.

The history of fiat money, to put it kindly, has been one huge major failure. In fact, EVERY fiat currency since the Romans first began the practice in the first century has ended in devaluation and eventual collapse, of not only the currency, but of the economy that housed the fiat currency as well.

Why would it be different here in the U.S.? Well, in actuality, it hasn’t been. In fact, in our short history, we’ve already had several failed attempts at using paper currency, and it is my opinion that today’s dollars are no different than the continentals issued during the Revolutionary War.

Fiat currencies have not been successful, and the only aspect of fiat currencies that have stood the test of time is the inability of political systems to prevent the devaluation and debasement of this toilet paper money by letting the printing presses run wild.

Sound familiar?

If there’s one thing that should be clear, it’s that nothing the government or their banking partners have done to solve the economic crisis has been for your benefit. They’ve enriched themselves, yet again, on the backs of the American people.

All the while, they’ve told us that everything is getting better. But anyone who’s paying attention know that nothing of the sort has happened. Printing our way out of debt is a sure indicator that our country is on the brink of a huge financial collapse.

“There’s fear and hysteria running through the entire global financial community, because as everybody knows all they did was postpone the inevitable.”

Make no mistake. It’s coming.

And when it hits, it’ll make the crisis of 2008 look like a picnic.

Learn How To Protect Your Wealth

Is it still possible to profit and protect your wealth with precious metals?

Continue reading this special message now to learn why you should not dismiss Silver or Gold and pass up this rare opportunity…

Some say our time is up! I say it has not even begun. Learn how you can still “catch a break” as new historic precious metals bull market gets underway.

Those who have followed David Morgan’s work heard him say this a thousand times… “If there is only one thing to teach you about the gold/silver bull market it is this; 90% of the move comes in the last 10% of the time!”

Yes, Gold and Silver have been through some ups and downs this past few years. But that is not why we are in these precious metals markets. We’re not sitting by the computer watching the markets ticks each day. That would be enough to drive any sane investor crazy.

We all know the truly big money in the precious metals bull run is still ahead. The panic phase has not even begun yet! And if history has anything to say it is this… we’ll panic.

The demand for silver as an investment is continually growing, but once faith in the dollar is gone, silver and gold will see record highs and you’ll see a flood of new precious metals investors hit the market.

Do you want to be in now or do you want to wait till everyone else gets in?

And as we brace ourselves for the final chapter of a U.S. dollar currency crisis, silver and gold will soar to record highs.

Let’s take a look at history. In 1980, as the nation was still reeling from the Carter-era inflation and investors were buying up precious metals, silver peaked at $52 an ounce. Adjusted for inflation, that’s about $143 today!

Those who get in now will be richly rewarded and can get a lot more for their money. Those who wait it may be too late once the crisis starts. Remember, you could not buy silver during this crisis because it was in such high demand. You has to wait 6 months and you paid a huge premium if you want to buy silver or gold.

Forget about the current price of silver and gold. Forget about the manipulated price suppression. Don’t bother yourself with who is right and wrong. You’re going to miss out. It’s only a matter of time before the debt and derivative markets crash, catapulting precious metals prices exponentially higher. There’s going to be a run to gold unlike anything in the history of mankind. The spillover into silver will be phenomenal, as well, because once it (debt markets) starts down, everyone that understands what’s going on, which will be very few, will be running to precious metals to protect their wealth.

Silver is going higher, there is no doubt. Where will you be when it does?

Learn How To Protect Your Wealth

Information contained herein has been obtained from sources believed to be reliable, but there is no guarantee as to completeness or accuracy. Because individual investment objectives vary, this Summary should not be construed as advice to meet the particular needs of the reader. Any opinions expressed herein are statements of our judgment as of this date and are subject to change without notice. Any action taken as a result of reading this independent market research is solely the responsibility of the reader.

The Morgan Report is not and does not profess to be a professional investment advisor, and strongly encourages all readers to consult with their own personal financial advisors, attorneys, and accountants before making any investment decision. The Morgan Report and/or independent consultants or members of their families may have a position in the securities mentioned. Mr. Morgan does consult on a paid basis both with private investors and various companies. Investing and speculation are inherently risky and should not be undertaken without professional advice. By your act of reading this independent market research letter, you fully and explicitly agree that The Morgan Report will not be held liable or responsible for any decisions you make regarding any information discussed herein.