Beyond Red and Blue: America’s Fiat Monetary System Is The True Threat To Your Prosperity

A Change in Leadership Won’t Magically Fix Our Economy. Without a Major Turnaround, We’re Still on Track for the Greatest Economic Collapse of Our Generation. Will You Be Ready When It Happens?

Regardless of who Won... Your Standard of Living is Still In Jeopardy

The Election May Be Over, But That’s Just the Start—Our Economy’s Fragile State Demands Immediate Action

Barring some miracle, can we still turn this sinking ship around?

One thing is for certain... this election will certainly further divide our nation and keep us distracted from the real issues.

The rift that emerged the moment the polls close is going to seem petty compared to what is still a brewing.

We’re facing the convergence of hidden financial forces—forces that have been quietly gaining momentum for years, and now they’ve reached their breaking point.

When these forces finally erupt, I believe they’ll set off an unstoppable chain reaction that splits the financial markets in two... wiping out the wealth of millions of unsuspecting investors while creating enormous profits for those who are prepared.

The side you find yourself on depends on the actions you take now, before this economic, social, and financial crisis hits its irreversible tipping point.

But no one is warning you about what’s really coming...

Everyone’s looking the other way.

And in doing so, they’re overlooking the financial shockwave that’s about to tear America apart, casting every citizen—no matter their political beliefs—into one of two camps: richer or poorer.

You know I'm right.

Let’s be honest—has life gotten any easier? Have your investments delivered better returns in recent years compared to the past? Are everyday essentials like gas, food, electricity, and housing becoming more affordable, or are they getting more expensive? Do you think a new President is going to save a failing fiat dollar or just kick the can down the road another 4 years?

If you're like most of us, the answer is a resounding NO!

That’s why I’m inviting you to become a member of my newsletter advisory membership.

My mission is clear: to help ensure you end up on the right side of this financial divide and land on the other side with your wealth and prosperity intact.

What is coming ahead are challenging times and are likely to get even worse.

Despite the turmoil ahead, I firmly believe that if you’re prepared, the next four years could present the greatest wealth-building opportunity of your lifetime.

Why? Because the aftermath of the 2024 Presidential election could see trillions of dollars shifting hands.

And while millions of unprepared Americans will find themselves on the losing side, if you’re positioned in the right investments, you could profit like never before.

How can I be so certain?

As the founder of the Morgan Report, I've been telling people like you exactly how to build and protect your wealth for the past 25 years.

I warned that inflation would climb, driving up the prices of everyday essentials higher.

I predicted housing costs would skyrocket, making homeownership increasingly out of reach for the average person.

I also cautioned that our government would keep printing money to manipulate the economy—a move that would spell trouble for everyone, especially those who have retirement savings like 401ks, Pensions and Savings.

As it turns out, I was right, just as we’ve seen unfold.

However, this election is different.

As I already said—regardless of who wins, whether it’s Trump or Harris—neither candidate can stop the collision of these financial forces.

Our reckless money-printing policies are going to leave the majority of you financially devastated.

In fact, whomever gets in office, will likely intensify the crisis. They’ll amplify the disruptions. And they’ll worsen the damage to your retirement portfolio, your savings, and your way of life.

But would you blame them—because they have no choice. Once we set foot on this path of printing, the decision was made for us. They have to keep printing more money, or the entire house of cards collapses! Nobody want that to happen on their watch, so they keep kicking the can down the road.

Let me be clear: this is not about politics. This isn’t about taking sides or telling you how to vote. I’ll leave that to the talking heads on TV.

What I know is that both candidates believe they can steer America away from the cliff. But as you’ve see with your own eyes and pocketbooks, they’re tragically mistaken. Their plans will only make the situation worse.

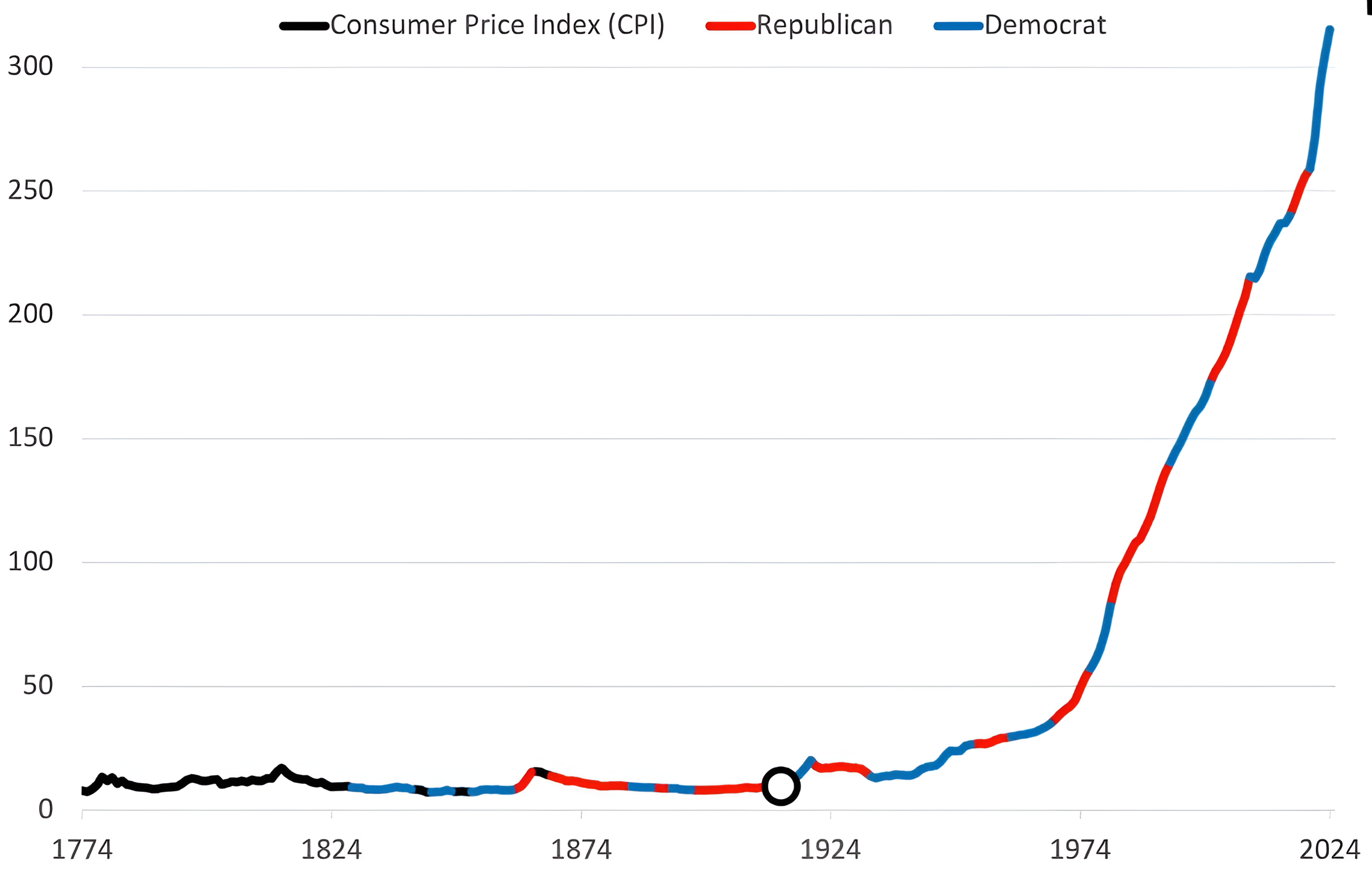

And the entire story can be seen in one powerful chart:

Had the establishment paid attention to this chart—just ten, or even five years ago—perhaps America wouldn’t be on the brink. But there’s no time to dwell on “what if.”

The course is set.

And when the polls close, the reckoning could begin.

That’s why it’s critical you join me on October 1st for this emergency election broadcast. I’ll reveal how this chart signals the financial divide that’s about to tear America apart.

While millions of investors are caught off guard, those who are prepared could see this as one of the greatest wealth-building opportunities in history.

And the entire story can be seen in one powerful chart...

In this chart, spanning over two centuries, the Consumer Price Index (CPI) of the United States has unveiled a story of stability, upheaval, and economic metamorphosis. The CPI, a measure that evaluates the average change over time in the prices paid by consumers for a basket of goods and services, is a critical indicator of inflation and the purchasing power of currency.

From 1800 to 2019, the chart tells us two parallel narratives: one measured in the longstanding store of value, gold, and the other in the more volatile measurement of the US dollar. The early part of the graph shows a CPI line that remains remarkably flat when measured (backed) in gold, indicating a consistent value over time.

The turning point arrives in 1971, the year President Richard Nixon "temporarily" detached the dollar from the gold standard, allowing it to float freely in the international currency markets. At this juncture, the CPI measured in dollars diverges sharply from the gold-measured CPI, embarking on a steep upward trajectory. By 2019, the CPI measured in dollars has skyrocketed to 2,517, a substantial inflation rate and a severe dilution of the dollar's purchasing power. And I don't need to remind you what happened post pandemic.

There’s one crucial detail about this chart that you might have overlooked. Notice how some lines are blue, while others are red—this color coding represents the political party in office at that particular time. But here’s the important takeaway: regardless of which party held power, both faced the same economic challenges and resorted to similar measures. Whether Democrat or Republican, every administration had to print and spend money to keep America’s economy afloat.

This trend underscores a deeper reality: the need to support the economy transcends party lines, illustrating how each leadership faced unavoidable pressures to maintain stability and growth. The chart tells a story of bipartisan necessity, where economic survival became a shared goal, no matter who was in charge.

So you need to grasp what's really happening here. This isn't a case of "which party is in office" the evidence is right in front of you.

Obstacles that lie ahead...

- US Dollar Is In A Perpetual Decline

- Massive Bank Failures

- Global Powers as At War

- FED Printing Unlimited Stimulus Money

- Stock Market Collapses

- COVID19 After Effects

- Cryptocurrency Collapse

- $34 Trillion In Federal Debt

- Underperforming Retirement Savings

- Tax Burden Is Overwhelming

- Political and Economic Upheaval

- Runaway Inflation

- Who has the best deals on buying and selling precious metals

I think you are starting to get the picture.

I've been warning people like you about the decline of the American Empire for some time. Despite the Federal Reserve's assertion that inflation is only 8%, the evidence suggests otherwise.

The stock market has taken a few significant hits and caused some investors to lose almost half their net worth. What most people miss is that if a stock drops by 50%, it needs to increase by 100% to return to its original purchase price. A stock that drops from $10 to $5 ($5 / $10 = 50%) must rise by $5, or 100%, to return to $10.

When you understand the drivers behind the economy and financial markets, you can have greater control of your life and finances. Our strategy is to put substantial capital into substantial companies. We offer some exciting speculations, but please use funds you can afford to lose.

As a member of The Morgan Report, you will know precisely how to navigate these markets, protect your wealth, and remain centered while those around you are flailing at any get-rich-quick scheme that worked in the past but will NOT work as things get REAL once again.

We're talking about opportunities that come along once every few centuries. When the next recession (depression), those who have invested in suitable locations and assets will be able to remain calm and help others, be it family, neighbors, or whole communities.

Discover Why Experts Hail The Morgan Report as the Gold Standard of Investment Newsletters

The Morgan Report is an exclusive membership-based publication that provides in-depth analysis and expert insight on the global economy and the financial markets.

The Morgan Report investment strategy is multifold, taking advantage of market conditions and looking at trends in the resource sector, such as which mineral is "hot" and why. How to exploit undervalued situations. Why The Morgan Rule will save you grief on making a poor decision. Let the market decide for you, and rest assured you will be correct most of the time.

The Morgan Report offers a revolutionary perspective on the world, investment strategies, future challenges, and wealth-building opportunities - a decisive shift in mindset awaits.

We are not your average "how to recession-proof your portfolio" newsletter. This is about making some serious gains during chaos and uncertainty. We're talking about seizing an incredible investment opportunity of a generation and coming out on top.

Sure, the global markets may be in turmoil right now, but that means there's plenty of money to be made for those who know where to look. And that's where I come in. My investment strategy is all about taking advantage of market conditions.

If you are not ready to join as a paid member, subscribe to our free newsletter to stay informed, awake, and aware.